AltC Acquisition Corp (ALCC) to Combine with Oklo in $850M Deal

AltC (NYSE:ALCC) has entered into a definitive agreement to combine with fission technology firm Oklo at a pre-money equity value of $850 million.

Santa Clara, California-based Oklo is working to develop small-scale nuclear fission plants that could fit on just a two-acre footprint.

The combined company is expected to trade on the NYSE under the ticker “OKLO” once the deal is completed in late 2023 or early 2024.

Transaction Overview

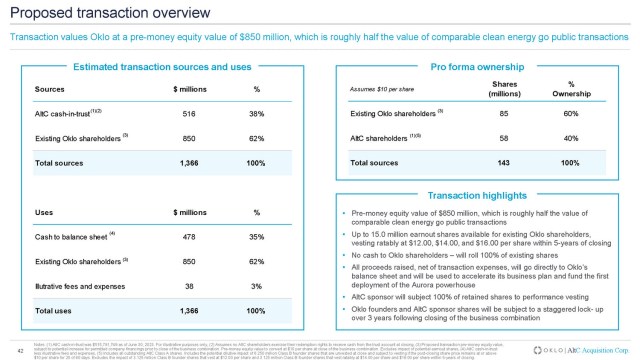

AltC has about $515.8 million in its current trust and has not yet supplemented this with additional committed financing.

Oklo expects to add $478 million to its balance sheet through the deal after paying $38 million in transaction fees and expenses. AltC must maintain at least $250 million in cash available in order for the deal to close.

Assuming no redemptions, existing Oklo shareholders are expected to own 60% of the combined company although it is permitted to issue additional shares as a part of equity funding raises before close. AltC shareholders would own 40% of the company at close.

AltC’s sponsor has subjected all of its promote shares to performance-based vesting benchmarks. Half of these are to vest when the company trades at or above $10 for 20 of 30 days following close. Another 25% will vest at a $12 price hurdle under the same terms and the remaining quarter is to be split between price hurdles of $14 and $16.

Company insider shareholders and the sponsor are to see their shares locked up under similar terms. Forty percent of these shares are to be locked for one year but may be traded early if company stock trades at or above $12 for 20 of 60 trading days. Another 30% is to be locked for two years but be eligible for early release at $14, and the remainder at either the three-year anniversary of close or $16.

Quick Takes: AltC’s trading volume on the day sits at about 5 million shares before noon, which is some of the highest engagement any SPAC has seen on announcement in 2023.

These days, it takes some big names to drive that level of traction. AltC is chaired by serial SPAC sponsor Michael Klein, who recently captured record levels of retail buzz before, during and after his de-SPAC of Lucid Motors (NASDAQ:LCID).

But, the bigger name may be Sam Altman, who, aside from serving as AltC’s CEO, also leads OpenAI, putting him front and center of debates around AI technology in 2023. He also knows a thing or two about Oklo as he has served as its chairman since 2015 after overeeing Y Combinator’s early investment in the business.

This investment was only about $120,000, according to PitchBook, and the company has only raised about $25 million in outside funding overall. That’s quite a modest sum over the course of 10 years in a sector as capital and R&D-intensive as nuclear fission.

This is even more surprising in light of the fact that Oklo plans to take the more asset-heavy approach of being the owner-operator of its plants.

Most new nuclear technology firms have opted for the lighter touch of simply licensing their technology and reaping recurring revenue from fees and supply arrangements from the owner-operators that would have the burdens of building and running the things.

The downsides of this approach, of course, is that these firms are limited in the revenue they can generate from each new plant as opposed to reaping the benefits of selling the energy itself.

What makes this possible for Oklo is the relatively small size of its each plant with its first projects envisioned to be 15 MW to 50 MW facilities.

By contrast, peer nuclear de-SPAC NuScale (NYSE:SMR) is producing modular reactor designs to generate a minimum of 77 MW each. X-Energy, meanwhile, which has a pending $2.2 billion combination with Ares (NYSE:AAC), has designs for modular reactor clusters of 80 MW and up.

Oklo believes its designs would meanwhile cost about $60 million each and could be built in under a year, regulatory approvals permitting. Each would be profitable within its first year of operation and entail no upfront capital needs for construction under Oklo’s proposed business model.

The company believes its designs would be a strong fit for customers seeking secure decentralized power sources not reliant on the wider grid like data center operators and defense sites. Its first site however would be something of a pilot plant at the Idaho National Laboratory run by the US Department of Energy.

Oklo has already cleared a number of the regulatory hurdles for this deployment and expects ground to be broken there in 2026 or 2027. If all goes to plan, this is a closer timeframe to operations than NuScale and X-Energy, which expect to generate their first power in 2029 or 2030.

But, the scale is also considerably different. NuScale’s first project is set to generate 462 MW and the company expected at announcement to bring in $672 million in revenue and $93 million in free cash flow from power supply agreements already in 2024E.

Oklo predicts its 15 MW model would generate $508 million in revenue and $281 million in free cash flow over 40 years of operations, or $12.7 million and $7 million annually. Built up to 50 MW, Oklo believes it could reap $36.3 million in revenue annually and $24.1 million in cash flow.

The parties have not shared full projected financials for the company, but if it keeps to schedule and its one 15 MW plant is up and running for all of 2026, then its equity valuation in this deal would equate to about 66.9x its 2026E revenue. NuScale is meanwhile trading at about 19x the revenue it generated over the past 12 reported months.

ADVISORS

- Oklo Advisors:

- Guggenheim Securities, LLC served as financial advisor

- Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP served as legal counsel

- Pillsbury Winthrop Shaw Pittman LLP served as nuclear regulatory counsel

- AltC Advisors:

- Ocean Tomo, a part of J.S. Held served as financial and technical advisor

- Citigroup Global Markets Inc. served as capital markets advisor

- Weil, Gotshal & Manges LLP served as legal counsel

- Morgan, Lewis & Bockius LLP served as nuclear regulatory counsel