Where Are They Now? – Simply Good Foods

In this series we’ll be examining successful SPAC deals from the past both in the terms and circumstances of their de-SPAC processes and how they have weathered the storms that have followed after their public listings with research from SPACInsider contributors Anthony Sozzi and Sam Beattie.

Last week, we took a ride in the way-back machine to fall of 2018 when Haymaker I was announcing an exciting new travel and hospitality deal in what they couldn’t have known was a sector about to implode thanks to a pandemic.

This week, we take a look at a consumer products sector that is typically steady, but rarely does it produce winners quite like Simply Good Foods (NASDAQ:SMPL). After closing its combination with Conyers Park I in 2017, Simply Good Foods leads all 52 consumer de-SPACs dating back to 2011 in price performance having last closed at $32.38 at a time when only six of these companies (11.5%) are trading above $10.

Five years ago, high-profile consumer SPAC deals were having a bit of a moment. Conyers Park I IPO’d on July 14, 2016, just a week after Gores I announced its $2.3 billion combination with packaged confectionary giant Hostess (NASDAQ:TWNK). This deal was perhaps the most head-turning SPAC transaction in the consumer space since Burger King had gone public again with the help of Martin Franklin’s London-listed SPAC Justice Holdings in 2012.

By the time Conyers Park I announced its combination with Atkins and SimplyProtein in April 2017, Hostess had rocketed up from its November close with Gores I to a monthly high of $17.17.

Atkins had ridden a popular low-carb, high-protein diet trend to a leading position in the snack bar category with a mix of consumers subscribed for recurring sales and consumers hopping in and out of the low-carb lifestyle.

Much like OneSpaWorld, Conyers Park I took what by 2022 standards is an unusually large stake in the target – then known as Atkins. The SPAC took 85% of the company’s equity with 71% going to public shareholders and 14% to Conyers Park I’s sponsor. This too mirrored the Hostess deal, wherein Gores I and affiliates acquired 83% of Hostess’ equity spread across public shareholders, the PIPE and promote.

Conyers Park I for its part supplemented its $403 million trust in the deal with a $100 million PIPE at $10 per share and $150 million in new debt. Outside of $25 million in transaction expenses, all of these $653 million in proceeds went towards cashing out selling shareholders. In certain circumstances, seeing an existing management sell out and head out of town can be a red flag for a deal, but this was not a half-built bridge they were selling.

The company that would eventually be known as Simply Good Foods generated $64 million EBITDA in 2016 leading into the combination and the group had been growing these earnings at a 9% CAGR for several years running.

From an open-market investor standpoint, this was an opportunity to jump on board for a corporate takeover by new management operators that had been successful in growing dozens of consumer brands including Hershey’s, Oreo and Planter’s Peanuts in the past. Long-time Conyers Park leaders James M. Kilts and Dave J. West took over as Atkins’ chairman and executive vice chairman, respectively.

And, by contrast to the SPAC boom times between 2020 and 2021, this well-known brand was coming to market at a relatively low price point at an enterprise value of just $856 million. From April 11, 2017 when Conyers Park I announced the deal through to its close on July 7, 2017, the SPAC never traded below $11. It closed with 0% redemptions at $11.84

Nonetheless, situated as we are in a market that has been unforgiving to de-SPACs for minor misses, it is interesting to see that Simply Good Foods was a company that missed the projections laid out in its announcement presentation in its first quarter as a public company and didn’t skip a beat. Simply Good Foods predicted at announcement that it would generate $402 million in net sales in 2017. But, it later missed with $396 million in net sales and even saw the sellers in the transaction sell 8,843,174 more shares in a secondary seven months after close in February 2018.

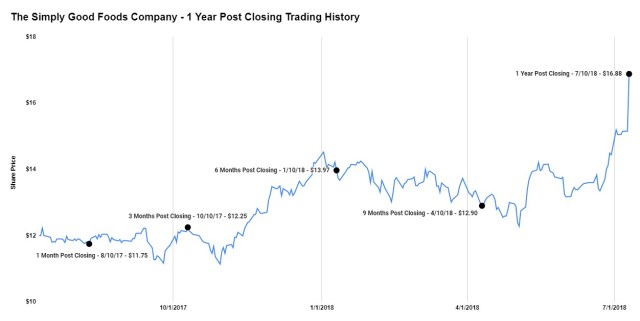

Neither event left a lasting dent on its share price, and Simply Good Foods stayed well in the money through its first year on the market. In October 2018, about 15 months out from close, Simply Good Foods redeemed all Conyers Park I warrants on a cashless basis, giving out 0.38115 shares per warrant because the company had traded at $18 or higher for 20 of 30 trading days.

Roughly a year later, Simply Good Foods closed its $1 billion acquisition of peer Quest Foods, significantly bolstering its low-carb snack and food portfolio. This grew its net sales to $816.6 million and adjusted EBITDA to $153.9 million for its 2020 fiscal year ending on August 29 of that year.

Simply Good Foods took a hit along with the rest of the market when the pandemic shock landed, dropping from a February 2020 high at $25.28 to a low at $14.75 on March 15, 2020. But, even this showed the kind of high floor that the stock would maintain throughout its de-SPAC life to this point. It gradually grew to an all-time high at $43.85 in April 2022 before getting caught in the more recent downturn.

It still closed Thursday at $32.38 for a 223.8% return on investment, which has left the Conyers Park team at the top of SPACInsider’s rankings among teams that have completed at least two deals. Simply Good Foods marked the fifth-year anniversary of its combination recently having more than quadrupled its enterprise value to $3.7 billion.

The company continued to fete the occasion last week by distributing about 8 million shares from the original Conyers Park I sponsor to members of its investment team, with its principals Kilts, West and Brian K. Ratzan receiving a majority of the roughly $270 million-worth of shares.

It remains an open question whether a deal structured like this one would be possible in the current market conditions. Takeovers by operator-led SPAC teams have become rarer and are now more difficult with redemptions high and the PIPE market tight. It seems a further stretch that the current market conditions would give any team or target the kind of benefit of the doubt that was seen a few years back.

However, Waldencast’s operator-led takeover of a majority position in cosmetics brands OBAGI and Milk Makeup (NASDAQ:WALD) is one recent example of such an approach. It continues to trade relatively well about three months out from its July 2022 close at $9.60.

Another example is Metals Acquisition Corp.’s (NYSE:MTAL) pending $1.1 billion takeover of Glencores CSA copper mine in Australia. This deal has the added benefit to being an EBITDA-positive target with tangible assets, and yet, for now, Metals continues to trade below trust value at $9.83 while the transaction works towards close.