Churchill Capital Corp. III Upsizes to $800 Million

If you need further evidence of a hot, hot SPAC market, tonight Churchill Capital Corp. III, which only has a 1/4 warrant included in it’s unit and can remove $1.0 million per year of interest for working capital, STILL managed to upsize their offering by $200 million. As of tonight, Churchill III’s offering is now $800 million, a size we haven’t come close to seeing since Silver Run II priced a $1,035.0 billion SPAC in March of 2017. Since then, the largest sized SPAC has topped out at $690 million (with over-allotments). However, keep in mind that if Churchill III completes their own full over-allotment, they can potentially raise $920 million when all is said and done.

This is a sizzling hot deal and IPO units are going to be scarce, even with an up-size, so chances are good that we see Churchill come out of the gate close to Gores IV’s high of $10.52 as a day-one open price. This also means that former teams, like TPG Pace and Social Capital Hedosophia, and maybe even some new teams, will almost certainly go for a 1/4 warrant as well. Although, Chamath Palihapitiya (former CEO and Chairman of Social Capital Hedosophia), currently has his hands full as Chairman of Virgin Galactic (currently trading around $23.00).

It’s a new world when an $600 million, 1/4 warrant SPAC, can still upsize $200 million as a “blank check” company. But guess what….in a market like this, we can probably expect more changes. Look for envelopes to be pushed now that the 1/4 warrant is “normal”. It’s not stopping here.

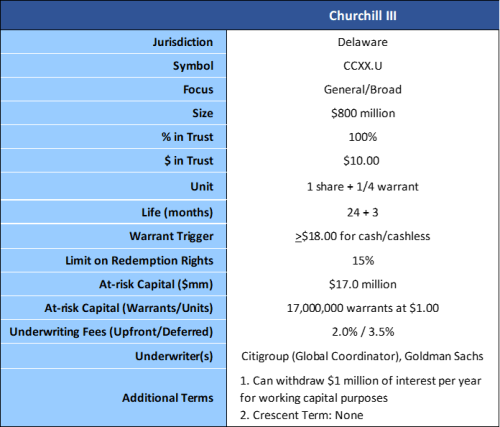

Summary of revised terms below: