Let’s Talk About SC Health’s Warrant Backstop

Did anyone catch the term in SC Health’s new SPAC filing on Friday? If you didn’t, SC Health added an interesting twist for warrant holders. Essentially, this SPAC will be backstopping the warrants at $1.00 in the event of a liquidation. PLUS, they’re giving all public warrant holders the right to require the Sponsors to repurchase their warrants at a $1.00, even if the combination is approved. (Update: Pure Acquisition Corp. (PACQ) used this as well)

Per the prospectus: “Each holder of public warrants (other than our sponsor and its affiliates) will have the right to require our sponsor to repurchase or cause one of its affiliates to repurchase, at $1.00 per public warrant, our outstanding public warrants in connection with the completion of our business combination. If we are unable to close our business combination within the allotted time, our sponsor will purchase or cause an affiliate to purchase any outstanding public warrants for $1.00 per public warrant at the same time as we redeem our public shares.”

This means that on a $10.00 unit purchase at IPO, rather than being assured you will at least get back just $10.00 on your investment for just the share, your now going to be made whole at $10.50 for both the share and warrant, in a worst case scenario. (Remember, SC Health is offering a 1/2 warrant in their unit).

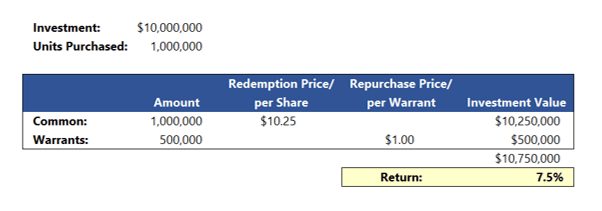

However, let’s assume an investor has made a $10 million purchase at IPO, or 1,000,000 units, and the current per-share redemption price is $10.25. Regardless of whether the SPAC combines or liquidates at that point, your initial $10 million purchase is now worth $10,750,000 if you redeem the share and the warrant is repurchased.

This warrant backstop is a BIG commitment on the part of the Sponsors since it’s potentially a $7.5 million repurchase. Remember, it’s not the target company that will be doing the repurchase of warrants, but as the prospectus states, it’s the Sponsor who is on the hook. That’s a lot of skin in the game.