Acamar Partners (ACAMU) Re-Files and Gets Ready to IPO

Acamar Partners refiled their S-1 tonight and looks to be getting ready to IPO next week. However, there was one important change to Acamar’s terms – they added the Crescent Term with a threshold of $9.20.

To date, there are now eight SPACs that have either IPO’d with the Crescent term or are on file to IPO with the term.

However, as of late, there is a clear delineation across perceived deal tiers. The tier-1 deals appear to be following Deutsche Bank’s lead by using their threshold of $9.20, first seen in RMG Acquisition Corp., whereas the deals underwritten by the tier-2 banks were previously using $9.50. The lone outlier being Andina III, which used a perplexing $8.50 threshold. The delineation makes sense in a way though. The tier-1 SPACs want to establish a coveted premium price as a way of emphasizing they can command better terms. However, the point of the term is to protect investors from a PIPE done at a price below $10.00. Not to establish position. However, the threshold seems to be being used as a way of signaling status.

The reality is (hopefully), none of these deals will need to use the Crescent Term at all. It’s like buying flood insurance. It just depends on how much you want (or are willing) to be covered. Just something to keep in mind.

Deals using the Crescent term to-date:

- EdtechX – $9.50

- Graf Industrial – $9.50

- Schultze – $9.50

- Andina III – $8.50

- RMG – $9.20

- DiamondPeak – $9.20

- Tortoise – $9.20

- Acamar: $9.20

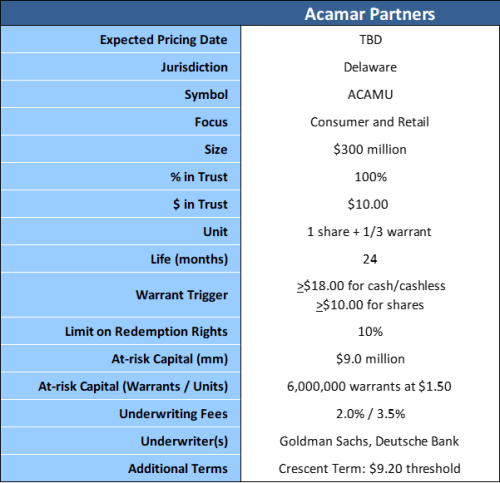

As for pricing, this new amendment indicates a pricing either late next week or early the week after next. It’s still a little too soon to make that call, but we’ll update as information becomes available. In the meantime, an update summary of terms is below:

Goldman Sachs and Deutsche Bank are bookrunners.

Ellenoff Grossman & Schole LLP and Skadden, Arps, Slate, Meagher & Flom LLP are issuer’s counsel and underwriter’s counsel, respectively.