HL Acquisition Corporation *

PROPOSED BUSINESS COMBINATION: Fusion Fuel Green Ltd

ESTIMATED CURRENT FUNDS in TRUST: $53.9 million*

CURRENT PER SHARE REDEMPTION PRICE: $10.58*

IMPLIED EQUITY VALUE: $96.7

*SPACInsider estimate

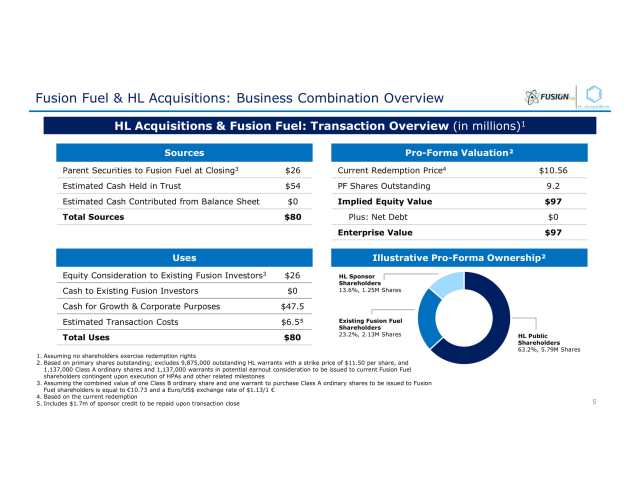

HL Acquisitions Corp. proposes to acquire Fusion Fuel Green Ltd, a clean energy company that has developed a proprietary technology and process for producing green hydrogen using concentrated photovoltaics. Following the consummation of the transaction both HL and Fusion Fuel Green Ltd will become wholly owned subsidiaries of a newly formed Irish parent (“New Fusion”), and will be led by the existing management team of Fusion Fuel Green.

SUBSEQUENT EVENTS 8-k August 25, 2020

HL Acquisitions Corp and Fusion Fuel Green Ltd (“Fusion Fuel Green”), jointly announced they have signed commitments for a private placement of 2.45 million shares of Fusion Fuel Green at a price of $10.25/share, representing gross proceeds of $25,112,500.

The closing of the Private Placement is conditioned upon, and will occur simultaneously with, the consummation of the Business Combination Agreement (“BCA”), dated as of June 6, 2020, between HL, Fusion Fuel Green, and the other parties thereto.

In connection with the Private Placement, the parties to the business combination have amended and restated the BCA to eliminate the condition that the combined company retain at least €22.8 million in net cash proceeds from HL’s trust fund upon the closing of the business combination.

The parties have also agreed to eliminate the financing earnout condition from the contingent consideration terms.

TRANSACTION SUMMARY

Fusion Fuel’s owners will receive 2,125,000 Class B ordinary shares of New Fusion, and 2,125,000 New Fusion warrants with the same terms and maturity of the HL warrants (except that they will be exercisable on a cashless basis and non-redeemable).

In addition, Fusion Fuel’s owners will be entitled to earn contingent consideration of up to 1,137,000 Class A ordinary shares and 1,137,000 New Fusion warrants upon the achievement of certain milestones. The Class A and Class B ordinary shares are identical except that so long as at least 1,700,000 Class B shares are held by the Fusion Fuel owners, New Fusion shall not take certain extraordinary actions without the consent of a majority of such Class B holders.

As part of the transaction, HL’s shareholders prior to its initial public offering (the “HL Founders”) have agreed to forfeit 125,000 ordinary shares of HL and 125,000 HL warrants. If no HL shareholders elect to redeem their shares for a pro rata portion of HL’s trust account, at the close Fusion Fuel’s owners will hold approximately 23% of New Fusion’s issued and outstanding shares.

FOUNDER SHARES and PRIVATE PLACEMENT PURCHASE

- Sponsors have agreed to forfeit 125,000 ordinary shares and 125,000 warrants of HL upon the consummation of the Transactions.

NOTABLE CONDITIONS TO CLOSING:

- no material adverse effect with respect to HL or the Company shall have occurred between the date of the Agreement and the closing

- HL having at least €22,800,000 in cash, net of:

- disbursements to HL public shareholders who elect to have their ordinary shares converted to cash,

- tax obligations of HL prior to the closing,

- repayment of HL loans,

- payment to EBC under the Business Combination Marketing Agreement entered into between EBC and HL in connection with HL’s initial public offering, and

- certain transaction expenses of the parties, and together with any funds raised by or for the benefit of HL in financings prior to the closing (the “Minimum Cash Condition”)

NOTABLE CONDITIONS TO TERMINATION:

- by either HL or the Company of the Transactions have not been consummated on or before January 2, 2021

ADVISORS

- Graubard Miller served as legal advisor to HL.

- and EarlyBird Capital served as financial advisor to HL.

- Fearnley Securities served as placement agent on the PIPE offering.

- Feinberg Hanson LLP, Arthur Cox, and Lisbonlaw Avogados served as legal advisors to Fusion Fuel.

HL ACQUISITIONS CORP. MANAGEMENT & BOARD

Executive Officers

Jeffrey E. Schwarz, 59

Chief Executive Officer

Mr. Schwarz is the co-founder of Metropolitan Capital Advisors, Inc., a New York-based money management firm founded in 1992. Mr. Schwarz served as Metropolitan’s Chief Investment Officer from the firm’s inception until his retirement in 2012. Since 2012, Mr. Schwarz has served as the Managing Member of Metropolitan Capital Partners V LLC, the investment vehicle of the Schwarz family office. Mr. Schwarz serves as the Co-Chairman of the Board of Bogen Corporation, a telecommunications equipment provider. He also serves as the Co-Chairman of the Board of Bogen Communications International Inc., which is the ultimate corporate parent of Speech Design GmbH, a global provider of messaging services to telecom carriers. Mr. Schwarz previously served as the Chairman of the Board of Molopo Energy Ltd., an Australian Stock Exchange listed, Calgary, Alberta-based oil and gas exploration and production company, and as a member of the Board of Directors of Cyberonics Inc., a NASDAQ listed medical device company. Mr. Schwarz received a BS in Economics (Summa Cum Laude) and an MBA from the Wharton School of the University of Pennsylvania.

Greg Drechsler, 49

Chief Financial Officer

Since 2007, Mr. Drechsler has served as Controller and Chief Financial Officer of Metropolitan Capital Advisors, Inc. Mr. Drechsler has also served as Chief Financial Officer of Metropolitan Capital Partners V LLC since April 2016. From 2001 to 2007, Mr. Drechsler held various financial management positions at Johnson & Johnson World Headquarters and its Veridex oncology diagnostics unit. In 2000, Mr. Drechsler served as Vice President of Administration at Homes.com. From 1994 to 2000, he served as Vice President of Mergers & Acquisitions and Manager of Financial Analysis at Cendant. Mr. Drechsler received a BS in Accounting (Summa Cum Laude) from Villanova University. He earned his CPA while working as a Senior Auditor from 1991 to 1994 at Deloitte & Touche, LLP.

Board of Directors

Rune Magnus Lundetrae, 41

Director

Since December 2016, Mr. Lundetrae has served as the Deputy Chief Executive Officer and Chief Financial Officer of Borr Drilling Ltd., the world’s largest premium jack-up rig operator. From August 2015 to December 2016, Mr. Lundetrae was a Managing Director and Head of Oil Services of DNB Markets, the investment banking subsidiary of DNB, Norway’s largest financial services group. From 2012 to June 2015, he served as Chief Financial Officer of Seadrill Ltd, the world’s largest offshore driller. From 2010 to 2011, Mr. Lundetrae served as Chief Financial Officer of Scorpion Offshore, an international offshore drilling company based in Houston, Texas and listed on the Oslo Stock Exchange. Mr. Lundetrae began his career with KPMG Stavanger, an auditing firm. Mr. Lundetrae received a BA in Business Administration from the University of Newcastle Upon Tyne, a M.Sc in IS Management from the London School of Economics and a M.Sc of Accounting and Finance from the Norwegian School of Economics. He is qualified as a CPA in Norway.

Ajay Khandelwal, 46

Director

Mr. Khandelwal has more than 20 years of diverse experience in multinational corporations in the energy and infrastructure sectors across India, the Middle East, Europe and the United States. Since December 2017, Mr. Khandelwal has served as the Chief Executive Officer of Chi Energie Private Limited, an Indian-based company seeking to broaden the access of Indian energy consumers (including industrial/commercial, city gas distribution (CGD) and heavy vehicle/buses transportation customers) to LNG. From 2013 to September 2017, Mr. Khandelwal served as President (Petroleum and Production) of Reliance Industries Limited, one of India’s largest oil companies. From 2010 to 2013, Mr. Khandelwal served as Chief Executive Officer of Jubilant Energy, an oil and gas export and production company based in India. From 2006 to 2009, Mr. Khandelwal served as an investment advisor to the family office of John Fredriksen, one of the world’s largest owners of shipping and oilfield services businesses, where he guided the investments of nine private equity funds in the U.S., Europe and Asia. From 2001 to 2006, Mr. Khandelwal served in several positions with Shell International, most recently as Lead Investment Finance Advisor, focusing on LNG business development and upstream M&A. Mr. Khandelwal received an electrical engineering degree from Victoria Jubilee Technical Institute in Mumbai and a M.B.A. from Cranfield School of Management in the United Kingdom.